In the realm of economics, the concept of profit-maximizing output holds a pivotal position, as it unveils a fundamental truth: there is no deadweight loss associated with the profit-maximizing output. This principle, deeply rooted in microeconomic theory, has profound implications for understanding market efficiency and the role of government intervention.

Profit-maximizing output, as the name suggests, is the output level at which a firm maximizes its profits. Firms meticulously determine this optimal output quantity by balancing marginal revenue and marginal cost. Various factors, including production costs, market demand, and competitive dynamics, influence the profit-maximizing output level.

1. Understanding Deadweight Loss

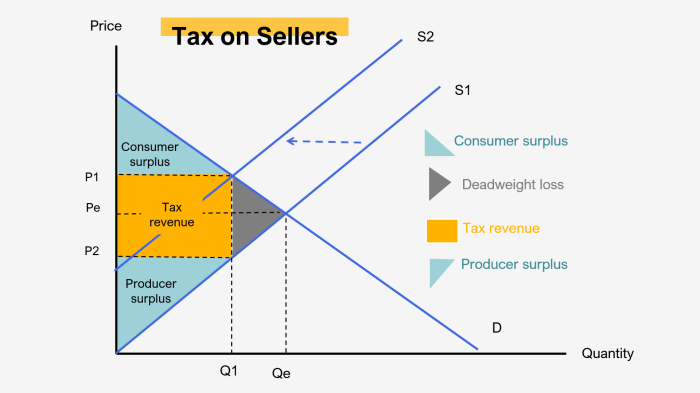

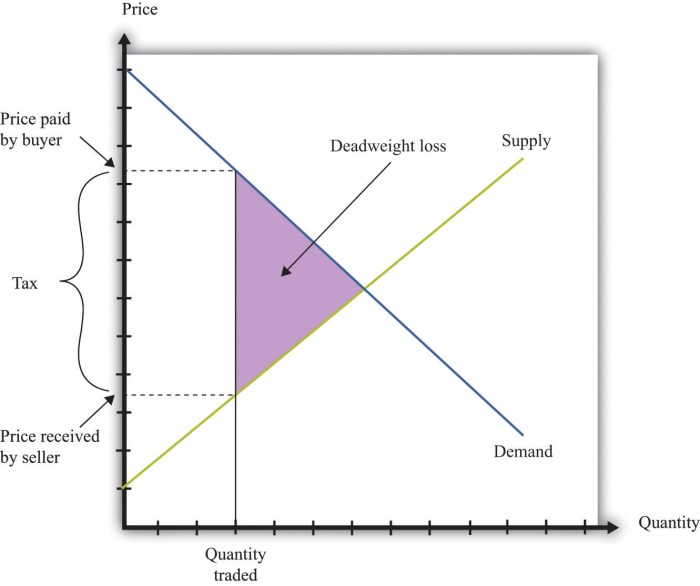

Deadweight loss is a measure of the economic inefficiency caused by market interventions such as price controls, taxes, or subsidies. It represents the net loss in consumer and producer surplus resulting from a deviation from the equilibrium price and quantity.

Deadweight loss arises when the market is prevented from reaching its equilibrium, resulting in a suboptimal allocation of resources. This can lead to lower overall economic output, higher prices for consumers, and reduced profits for producers.

Examples of Deadweight Loss

- Price ceilings:When the government sets a price ceiling below the equilibrium price, it creates a shortage, leading to deadweight loss.

- Price floors:When the government sets a price floor above the equilibrium price, it creates a surplus, resulting in deadweight loss.

- Taxes:Taxes on goods or services can lead to deadweight loss by distorting market incentives and reducing economic activity.

- Subsidies:Subsidies on goods or services can also lead to deadweight loss by encouraging overproduction or consumption.

2. Profit-Maximizing Output

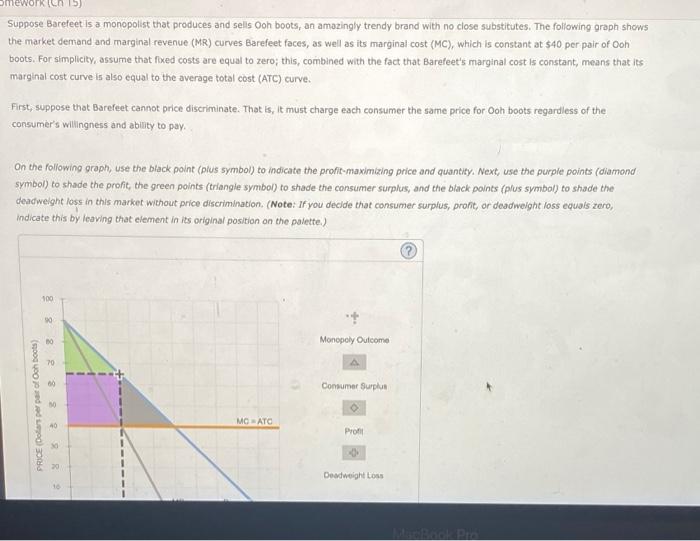

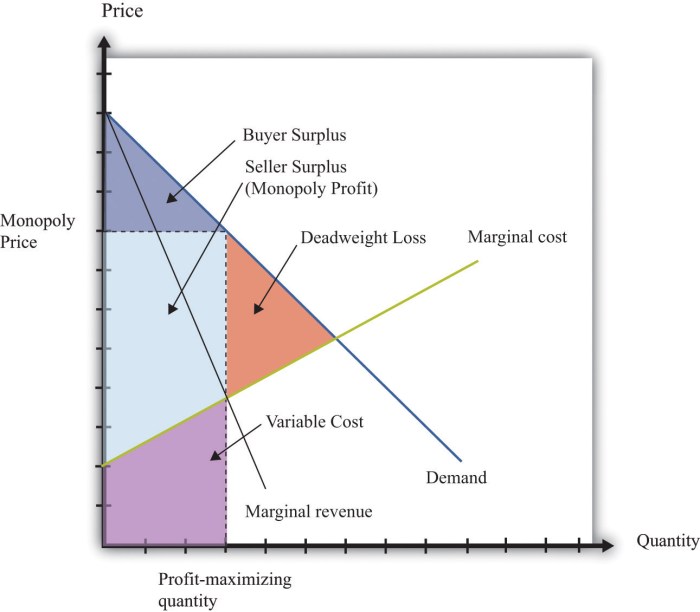

A firm’s profit-maximizing output level is the quantity of output that maximizes its total profit. This occurs when the marginal revenue (MR) from producing one additional unit of output is equal to the marginal cost (MC) of producing that unit.

Firms determine their profit-maximizing output by comparing MR and MC. If MR exceeds MC, the firm can increase profits by producing more output. Conversely, if MC exceeds MR, the firm can increase profits by reducing output.

Factors Influencing Profit-Maximizing Output Level, There is no deadweight loss associated with the profit-maximizing output.

- Market demand

- Production costs

- Government regulations

- Technological advancements

3. No Deadweight Loss at Profit-Maximizing Output

In a perfectly competitive market, there is no deadweight loss at the profit-maximizing output level. This is because the profit-maximizing output is also the socially optimal output.

At the profit-maximizing output level, MR = MC, which means that the additional benefit to consumers from consuming one more unit of output is equal to the additional cost to producers of producing that unit. Therefore, there is no net loss in consumer or producer surplus, and no deadweight loss.

Assumptions and Limitations

- Perfect competition

- No externalities

- No market imperfections

4. Implications for Economic Policy

The absence of deadweight loss at profit-maximizing output has implications for government policies that affect market outcomes.

For example, if the government imposes a price ceiling below the profit-maximizing output level, it will create a shortage and deadweight loss. Similarly, if the government imposes a price floor above the profit-maximizing output level, it will create a surplus and deadweight loss.

Examples

- Minimum wage laws:Minimum wage laws can lead to deadweight loss if they are set above the equilibrium wage rate.

- Agricultural subsidies:Agricultural subsidies can lead to deadweight loss if they encourage overproduction and distort market incentives.

5. Exceptions to the Rule

There are some exceptions to the rule that there is no deadweight loss at profit-maximizing output. These exceptions occur when there are market imperfections or externalities.

Examples

- Natural monopolies:Natural monopolies are industries where a single firm has a significant market share and can restrict output to increase profits, leading to deadweight loss.

- Externalities:Externalities are costs or benefits that are not reflected in the market price of a good or service. Negative externalities, such as pollution, can lead to deadweight loss.

Essential FAQs: There Is No Deadweight Loss Associated With The Profit-maximizing Output.

What is deadweight loss?

Deadweight loss refers to the economic inefficiency that arises when the quantity of goods and services produced falls below the socially optimal level.

Why is there no deadweight loss at the profit-maximizing output?

At the profit-maximizing output, firms produce the quantity of goods and services that equates marginal revenue and marginal cost, ensuring that resources are allocated efficiently.

What are the implications of this principle for government policy?

Governments should refrain from policies that interfere with the profit-maximizing output level, as such interventions can lead to market distortions and reduced economic efficiency.